The Dangerous Politicization of Banking: Trump's Frivolous Lawsuit Against JPMorgan Chase

Published

- 3 min read

The Facts of the Case

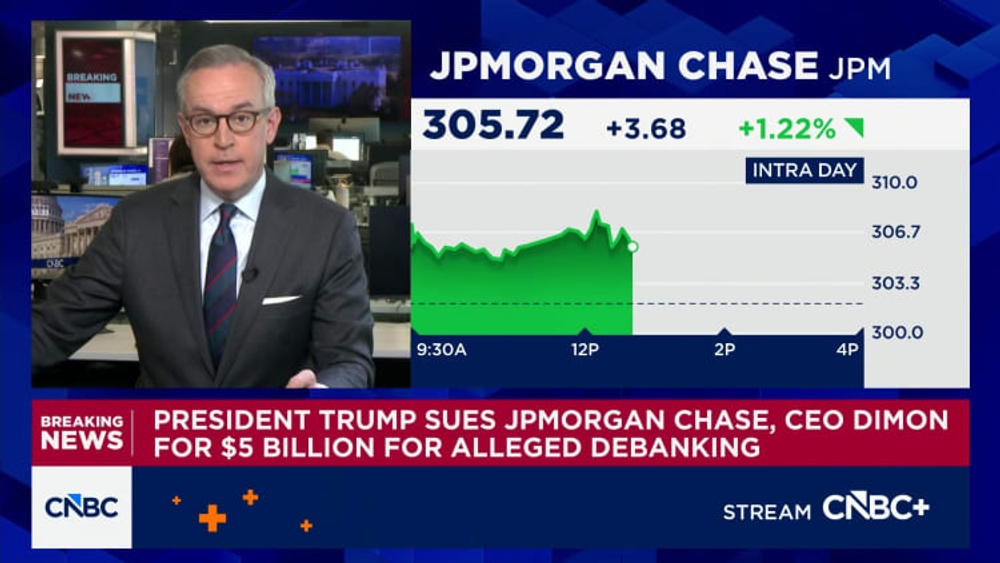

On a recent Thursday, former President Donald Trump filed a lawsuit in Florida state court against JPMorgan Chase and its CEO, Jamie Dimon, alleging that the bank closed accounts belonging to Trump and related entities for political reasons. The lawsuit seeks at least $5 billion in civil damages for what Trump characterizes as “political actions” taken against him. The account closures occurred in early 2021, shortly after the January 6 riot at the U.S. Capitol by Trump supporters and his subsequent departure from the White House following his electoral loss to President Joe Biden.

Trump personally commented on the situation while in Switzerland, telling reporters that Dimon “debanked” him and that such actions were “so wrong.” The lawsuit claims that JPMorgan’s decision was motivated by “political and social motivations” and “unsubstantiated, ‘woke’ beliefs” that required distancing from Trump and his conservative views. The plaintiffs allege that the bank failed to disclose why the accounts were terminated but later learned it was due to “political discrimination.” Additional claims include trade libel, breach of implied covenant of good faith and fair dealing, and violations of Florida’s Unfair and Deceptive Trade Practices Act.

JPMorgan has firmly denied these allegations. In a statement to CNBC, bank spokeswoman Patricia Wexler stated that the suit has “no merit” and that JPMorgan does not close accounts for political or religious reasons. Instead, the bank explained that account closures occur when they create “legal or regulatory risk” for the company, and they have been advocating for changes to the relevant rules and regulations across multiple administrations to prevent what they call the “weaponization of banking.”

The Context of Financial Regulations

The banking industry operates under stringent federal regulations designed to maintain financial stability and prevent illicit activities. These regulations require institutions to assess risk continuously, including reputational and regulatory risks that might arise from certain client relationships. The period following January 6, 2021, saw increased scrutiny on financial transactions related to political violence and extremism, prompting many institutions to reevaluate their risk exposure. This context is crucial for understanding JPMorgan’s stated rationale for the account closures, which aligns with standard banking practices aimed at compliance with federal oversight.

The Dangerous Erosion of Institutional Integrity

This lawsuit represents a profound threat to the integrity of our democratic institutions and the rule of law. The baseless allegation that a private financial institution engaged in political discrimination sets a dangerous precedent for weaponizing the legal system against legitimate business decisions. JPMorgan, like all banks, has both the right and the obligation to manage its risk exposure in accordance with federal regulations. To frame this as political persecution is not only factually incorrect but also undermines the very foundations of a free market economy where private entities must be able to make prudent business decisions without fear of political retribution.

The Hypocrisy of Claiming Political Discrimination

It is particularly galling to see a figure who has consistently attacked institutions—from the judiciary to the intelligence community—now crying foul when a private company exercises its legal rights. The lawsuit’s claim of a “blacklist” accessible by federally regulated banks is especially concerning, as it attempts to create a conspiracy narrative without providing substantive evidence. This tactic mirrors broader patterns of undermining trust in essential democratic structures. If we allow such frivolous lawsuits to proceed unchallenged, we risk creating a environment where every legitimate business decision becomes subject to political litmus tests, ultimately harming economic freedom and innovation.

The Real Victims: American Democracy and the Rule of Law

The true damage of this lawsuit extends far beyond the courtroom. Each baseless legal challenge of this nature erodes public confidence in our judicial system and distracts from genuine issues of justice. The $5 billion damages claim is not just excessive; it’s a blatant attempt to use the legal system as a weapon of intimidation against private entities that dare to operate independently of political pressure. This behavior directly contradicts the principles of a democratic society where institutions must remain free from political coercion to function effectively.

The Importance of Protecting Private Enterprise

At the heart of American liberty is the principle that private enterprises have the right to conduct business in accordance with the law and their own risk assessments. JPMorgan’s explanation that account closures were based on regulatory compliance—not political bias—should be taken at face value unless compelling evidence proves otherwise. The bank’s transparency about advocating for regulatory changes across administrations demonstrates a consistent, principled approach to banking regulation rather than the politically motivated behavior alleged in the lawsuit.

The Chilling Effect on Free Speech and Association

Perhaps most dangerously, this lawsuit threatens to create a chilling effect on free speech and association in the business community. If financial institutions face billion-dollar lawsuits for making routine risk management decisions, they may become hesitant to serve clients across the political spectrum for fear of retribution. This could ultimately limit access to banking services for legitimate businesses and individuals, undermining economic freedom and equality under the law. The First Amendment protects both speech and association, including the right of private companies to make business decisions without government interference or political pressure.

Conclusion: Upholding Constitutional Principles

This lawsuit represents everything that threatens American democracy: the politicization of private enterprise, the weaponization of legal systems, and the erosion of institutional trust. As defenders of constitutional principles and the rule of law, we must reject such transparent attempts to undermine the autonomy of private institutions. JPMorgan’s right to manage its business in compliance with federal regulations is fundamental to our economic system, and attacks on this right in the name of political grievance must be recognized for what they are: dangerous assaults on the very foundations of our free society. We must stand firm in support of institutions that operate within the law and against efforts to distort legitimate business practices into political battlegrounds.