The Corporate Takeover of American Homes: A Crisis Demanding Immediate Action

Published

- 3 min read

The Housing Affordability Crisis Context

The American housing market faces an unprecedented crisis that strikes at the very heart of the American Dream. For decades, homeownership represented the pinnacle of economic achievement and stability for American families. Today, that dream is being systematically dismantled by corporate investors and institutional money that treats homes not as places where families build lives, but as commodities to be exploited for maximum profit. The situation has become so dire that it has captured the attention of political leaders across the ideological spectrum, from President Donald Trump to Congressional Democrats, all recognizing that immediate intervention is necessary to prevent the complete corporatization of American housing.

The Legislative Landscape

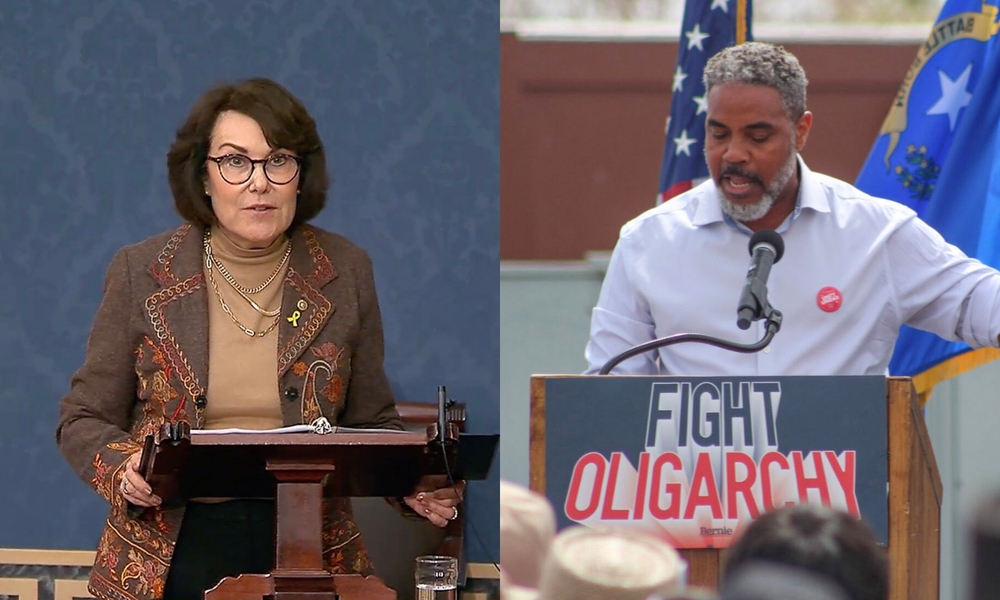

The current political response to this crisis reveals both consensus and division in how to address corporate homeownership. President Trump’s recent call for a federal ban on corporate homeownership represents a significant shift in the housing policy conversation. Meanwhile, Nevada Congressional Democrats U.S. Rep. Steven Horsford and U.S. Sen. Jacky Rosen have sponsored the Housing Oversight and Mitigation Exploitation (HOME) Act, which takes a more nuanced approach focused on monitoring and investigation rather than outright bans.

The HOME Act represents a carefully crafted legislative response that acknowledges the complexity of housing markets across different regions. Rather than imposing a one-size-fits-all cap, the legislation triggers investigations when corporate investors purchase more than 5% of single-family housing units in a market over a three-year period. This market-concentration approach recognizes that the impact of fifty corporate-owned homes in Las Vegas differs dramatically from the same number in Elko, Nevada.

The Political Dynamics

The housing crisis has created strange political bedfellows, with Republicans who previously resisted regulation now expressing support for measures to rein in corporate investors. Nevada Republican Gov. Joe Lombardo, who has historically opposed state-level efforts to limit corporate homeownership, suddenly announced he was “actively developing” a working group on the issue following Trump’s social media post. This political shift underscores how severe the housing affordability crisis has become and how it transcends traditional partisan divides.

However, the path to meaningful legislation remains challenging. Previous Democratic efforts to limit corporate investors have failed due to lack of Republican support. The question now is whether Trump’s endorsement of the concept will generate sufficient bipartisan momentum to pass substantive legislation. The details of Trump’s proposal, which he promised to outline at the Davos Summit, will be crucial in determining whether real progress can be achieved.

The Human Cost of Corporate Ownership

Behind the legislative debates and political maneuvering lies a profound human tragedy. American families are being priced out of homeownership not because of market forces or individual economic circumstances, but because massive institutional investors with virtually unlimited capital are systematically acquiring single-family homes. These corporations often convert these properties into rental units, frequently engaging in practices that critics describe as price-gouging and exploitative.

The consequences extend far beyond individual families unable to purchase homes. Communities suffer when corporate owners lack the commitment to neighborhood stability that individual homeowners provide. Rental properties owned by distant corporations often receive less maintenance and investment, leading to declining property values and community cohesion. The very fabric of American communities is being unraveled by this corporate takeover.

The Principle of Housing as a Human Right

At its core, this crisis represents a fundamental conflict between two visions of American society: one where housing serves as a foundation for family stability and community building, and another where housing becomes just another asset class for financial speculation. The principle that every American family deserves the opportunity to own a home is deeply embedded in our national identity and economic philosophy.

Corporate homeownership represents a dangerous concentration of economic power that undermines both economic freedom and social stability. When large institutional investors control significant portions of the housing stock, they gain disproportionate power over rental markets and housing prices. This concentration of power threatens the competitive markets that conservatives traditionally champion and the community values that liberals seek to protect.

The Need for Comprehensive Solutions

While the HOME Act represents an important step forward, Sam Garin of the Private Equity Stakeholder Project rightly notes that addressing the housing crisis requires a multifaceted approach. No single policy solution will suffice to address the complex interplay of factors driving housing unaffordability. We need a comprehensive strategy that includes not only monitoring corporate ownership but also addressing tax incentives that encourage speculative investment, strengthening tenant protections, and increasing the supply of affordable housing.

The legislation’s provision limiting investments from Fannie Mae and Freddie Mac to investors that violate renter protections is particularly crucial. Government-sponsored enterprises should not be facilitating the very practices that undermine housing affordability and stability. This represents exactly the kind of accountability mechanism that must be built into any meaningful housing legislation.

The Accountability Imperative

As Garin emphasizes, any policy solution must include robust enforcement mechanisms that ensure violations carry meaningful consequences. For multi-billion dollar corporations, small fines often become merely “the cost of doing business” rather than actual deterrents. Legislation must create real accountability that changes corporate behavior and protects American families.

The involvement of both federal and state governments will be essential in creating a comprehensive regulatory framework. While federal legislation can establish baseline protections and monitoring, states must have the flexibility to address specific regional market conditions and implement additional protections as needed.

The Path Forward

The emerging bipartisan recognition of the corporate homeownership crisis represents a rare opportunity for meaningful progress on a issue that affects millions of Americans. However, we must ensure that political rhetoric translates into substantive action. The American people deserve more than symbolic gestures or half-measures that fail to address the root causes of the housing affordability crisis.

We must demand legislation that includes strong monitoring provisions, meaningful enforcement mechanisms, and comprehensive approaches that address both the supply and demand sides of the housing equation. The HOME Act provides a solid foundation, but it must be strengthened with additional provisions that ensure corporate investors cannot circumvent the spirit of the law through technicalities or legal loopholes.

The corporate takeover of American homes represents not just an economic crisis, but a moral one. It strikes at the heart of what makes America exceptional: the promise that hard work and determination can lead to homeownership and economic security. We must act now to protect that promise for current and future generations of Americans. Our commitment to democracy, freedom, and liberty requires nothing less than vigorous defense of the American Dream against corporate exploitation and greed.