The Billionaire Tax Act: A Moral Imperative for California's Healthcare Survival

Published

- 3 min read

The Looming Catastrophe

California’s healthcare system stands on the precipice of collapse, threatened by $100 billion in federal health care cuts that will strip approximately $30 billion annually from Medi-Cal funding. This isn’t theoretical economic policy - it’s a life-and-death equation for millions of vulnerable Californians. The story of Elijah, a 7-year-old boy with cerebral palsy whose survival depends on Medi-Cal, illustrates the human cost of these cuts. His medications alone cost over $5,000 monthly, a sum that would be impossible for any working family to bear without institutional support. Emergency rooms that provide critical care during his seizures may soon close, leaving families without essential medical infrastructure.

The Human Face of Healthcare Cuts

Elijah’s grandmother, a nursing assistant and union member, represents the countless caregivers who understand the brutal mathematics of healthcare austerity. She describes caring for her grandson as a “full-time, all-hands-on-deck operation” requiring in-home nurses, multiple therapies, school support, and extensive medications. None of this care is optional - it constitutes the basic requirements for keeping a child alive, learning, and thriving. The proposed federal cuts would render this care unaffordable and inaccessible, forcing families into impossible choices between financial ruin and their loved ones’ survival.

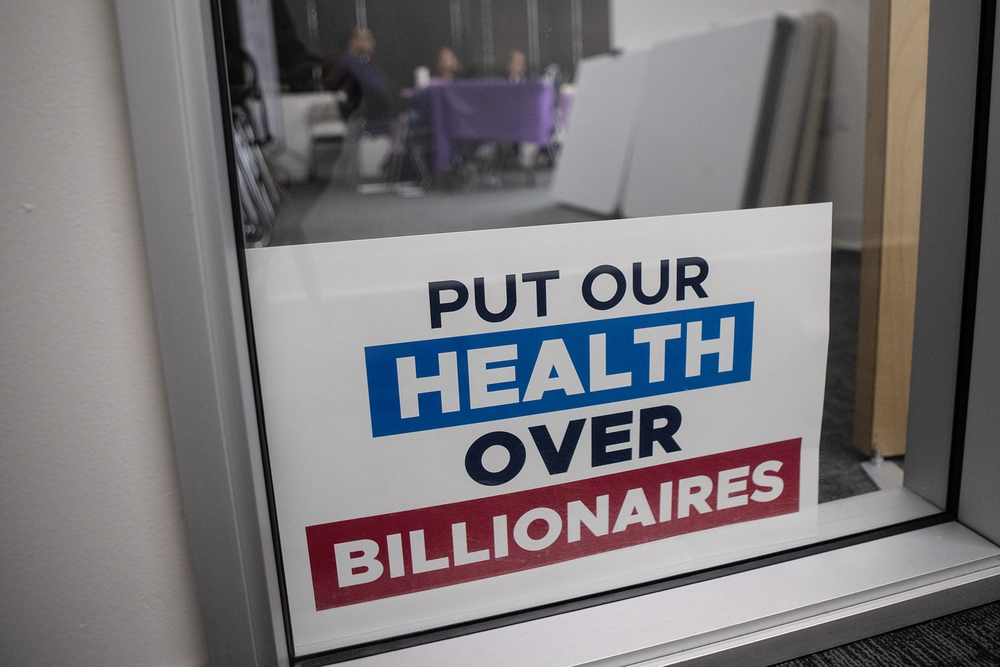

The Proposed Solution: Billionaire Tax Act of 2026

The 2026 Billionaire Tax Act offers a straightforward, equitable solution to this crisis. The measure would impose a one-time 5% emergency tax on Californians with wealth exceeding $1 billion - approximately 200 individuals who collectively hold over $2 trillion in assets. Structured over a five-year span, this tax would raise $100 billion for California’s healthcare system, preventing hospital closures, protecting Medi-Cal, avoiding healthcare worker layoffs, and maintaining insurance coverage for 3.4 million at-risk Californians. Crucially, due to existing tax loopholes, most of this wealth would otherwise never be taxed.

Moral Mathematics Versus Economic Arguments

The opposition to this measure typically frames it as “punishing success,” but this argument collapses under moral scrutiny. Working families already pay their share through every difficult bill-paying decision, every double shift worked, every anxious hour spent in emergency rooms praying for their children’s survival. The request for billionaires to contribute a modest portion of their wealth - wealth that likely wouldn’t be taxed otherwise - represents not punishment but basic societal responsibility. When the survival of children like Elijah hangs in the balance, abstract economic theories must yield to concrete human needs.

The Broader Implications for Democratic Principles

This healthcare funding crisis tests fundamental democratic values about whose lives matter in our society. A system that protects billionaires’ wealth while allowing children to die from preventable medical neglect betrays the foundational principle that all people are created equal. The Constitution’s promise of life, liberty, and the pursuit of happiness becomes meaningless if citizens cannot access life-saving medical care. The Billionaire Tax Act represents more than fiscal policy - it embodies a commitment to the democratic ideal that society’s strongest members have responsibility toward its most vulnerable.

The Political Landscape and Public Support

Despite opposition from wealthy interests and their lobbyists, this measure enjoys broad support across political spectrums. When confronted with the reality of sick children and endangered family members, ideological differences often fade behind the urgent need for survival. This bipartisan consensus reflects the universal understanding that healthcare is not a luxury but a fundamental human right. The campaign to place this proposal on the ballot represents democracy in action - citizens organizing to address a crisis that elected officials have failed to resolve.

A Test of Our Humanity

The confrontation between billionaire wealth and children’s survival represents a moral crossroads for California and the nation. We face a clear choice: allow our healthcare system to collapse, sacrificing vulnerable lives to protect extreme wealth, or demonstrate collective responsibility through modest wealth redistribution. The mathematics are simple, the moral imperative undeniable. As Elijah’s grandmother notes, the ultra-wealthy “wouldn’t even feel” this tax, while for families like hers, it represents the difference between life and death. In a society that claims to value human dignity, there can only be one righteous choice.

The Path Forward

California stands at the cliff’s edge, but this disaster remains preventable. The Billionaire Tax Act offers a practical, fair solution that aligns with both economic rationality and moral necessity. As voters consider this proposal, they must ask fundamental questions about the kind of society we wish to inhabit: one that protects extreme wealth at the cost of human lives, or one that ensures basic healthcare for all citizens through shared responsibility. The survival of children like Elijah, and the integrity of our democratic principles, hangs in the balance.