Singapore's Development Mirage: When Economic Success Masks Human Costs

Published

- 3 min read

The Singapore Development Model: Facts and Context

Singapore’s economic journey since independence in 1965 represents one of the most studied development narratives of the post-colonial era. The city-state’s strategy has been characterized by extreme openness to trade and foreign direct investment, disciplined macroeconomic management, and world-class infrastructure development. However, what distinguishes Singapore’s approach is the unprecedented degree of state involvement in the economy—the government plans land use, owns most land, channels compulsory savings, and exercises strategic ownership through sovereign wealth funds and government-linked companies.

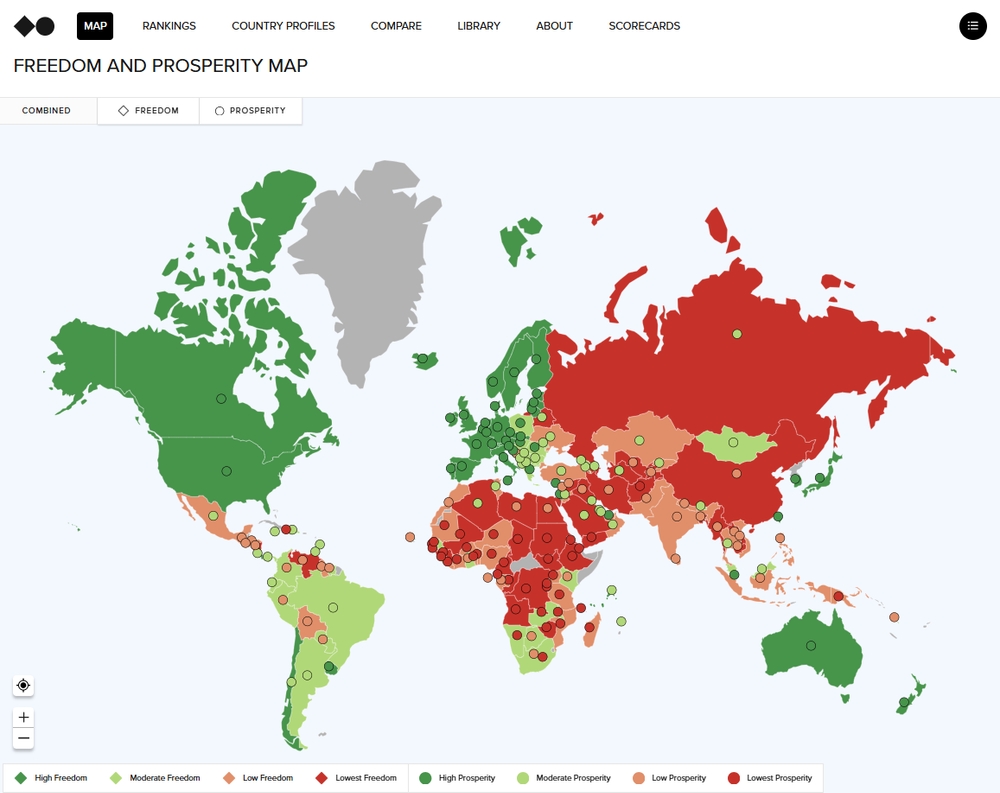

This state-market fusion has produced remarkable outcomes: GDP per capita has tripled since 1990, placing Singapore among the world’s wealthiest nations. The country boasts high life expectancy, educational attainment, and impressive infrastructure. External measures of economic freedom consistently rank Singapore at the top, celebrating its contract enforcement, low tariffs, and investment openness.

Yet beneath these headline numbers lies a more complex reality. Singapore’s growth has been extensive rather than intensive—driven by adding capital and labor rather than sustained productivity gains. The model relies heavily on foreign labor inflows, with non-permanent immigrants comprising 39% of the labor force. This approach has created a dual labor structure where low-wage foreign workers perform physically demanding jobs while higher-skilled foreigners fuel demand for scarce urban resources, particularly housing.

The Political-Legal Framework: Controlled Democracy

Singapore combines strong commercial rule of law with persistently narrow political competition. While elections are regular and cleanly administered, the playing field is shaped by districting changes before each election, brief nine-day campaign periods, and a tradition of defamation actions against critics. Mainstream media operates under substantive state ownership and oversight, while online speech is governed by broad statutes like POFMA (2019) and FICA (2021) that grant the executive sweeping powers.

The legal environment creates ambiguity for those engaged in contentious public speech or organizing. For commercial actors, rules are clear and enforcement swift; for citizens considering political contestation, boundaries are less legible and costs potentially high. This asymmetry lowers the expected return on civic initiative and removes valuable feedback mechanisms the state needs for course correction.

The Architecture of Control: Land, Housing, and Savings

Singapore’s state-economy nexus is particularly visible in land, housing, savings, and capital allocation. The government owns nearly all land and leases public housing on 99-year terms, meaning “market prices” are necessarily policy-shaped. The Central Provident Fund holds employees’ mandatory savings (37% of compensation) and links most to housing purchases and government-defined uses. Sovereign wealth funds Temasek and GIC intermediate large public assets while government-linked companies dominate substantial corporate sectors.

This architecture has delivered order and scale but has also raised economy-wide prices, encouraged rent extraction through asset inflation, and tilted returns toward capital and land rather than labor. When the state functions as de facto landlord, employer, investor, banker, business partner, regulator, customer, supplier, and competitor, experimentation by private enterprise narrows not by prohibition but by crowding out.

The Human Costs: Inequality and Social Strain

The distributional consequences of this model are profound. Singapore’s income inequality exceeds Scandinavian counterparts, with a Gini coefficient of 0.435 before transfers (0.364 after). These numbers likely underestimate actual inequality since they exclude non-permanent immigrants (concentrated at the lower income distribution) and non-labor income (more than half the total).

Labor’s share of national income stands at just 37%, while gross operating surplus and property-related incomes account for 54%. Private consumption’s share of GDP has declined from 49% in 2001 to 36% in 2024—strikingly low for an advanced economy. Housing policy amplifies these effects by linking forced savings to Housing Board purchases, creating wealth effects for owners but significant uncertainty as leases age and policy shifts.

The educational system, while producing high test scores, relies heavily on private tuition (70% of students), exacerbating unequal outcomes. The economic structure fails to generate sufficient high-productivity, middle-income jobs outside elite tracks, meaning credentials don’t guarantee commensurate wages.

Geopolitical Challenges and the Need for Reform

The external environment that enabled Singapore’s success is changing dramatically. Globalization is retrenching, tolerance for mercantilist policies is narrowing, and great-power rivalry intensifies. Regional competitors combine improving infrastructure with labor costs Singapore cannot match. Technological disruption, particularly from artificial intelligence, complicates long-term planning.

In this new context, doubling down on the old model—optimized for inflows of foreign labor and capital—will yield diminishing returns and increasing vulnerabilities. The article identifies five imperative reforms: shifting from extensive to intensive growth; revisiting surplus and reserve usage; reorienting land and housing policy to lower systemic costs; catalyzing broad-based experimentation rather than picking winners; and evolving the political-legal setting to allow more robust debate.

A Critical Perspective: The Development Mirage

From our standpoint as advocates for genuine global South development, Singapore’s model represents a cautionary tale rather than an exemplar. This is not development—it’s a carefully managed corporate-state partnership that prioritizes macroeconomic indicators over human flourishing. The model demonstrates how economic success can be achieved while maintaining significant political control and social constraints.

Singapore’s approach essentially represents state capitalism with neoliberal characteristics—open to global capital while maintaining domestic control. This hybrid model serves elite interests while ordinary citizens bear the costs through rising inequality, constrained freedoms, and policy-shaped risks. The system generates impressive aggregate outcomes while households at the lower end experience stagnant real wages and rising costs.

The political constraints have practical economic consequences. Constraints on expression reduce policy discussion diversity and depth. When dissent is costly and information selectively released, the system hears less from those who see problems first: low-wage workers, squeezed middle-class families, independent researchers, and small firms facing rising costs. This isn’t an abstract normative concern but a practical handicap in a complex, rapidly changing economy.

Singapore’s development story challenges the Western narrative that political freedom necessarily accompanies economic development. However, it also demonstrates the limitations of development measured primarily by GDP rather than human capability expansion. South Korea and Taiwan show that political liberalization can reinforce rather than undermine stability as economies mature.

The fundamental question is: development for whom? Singapore’s model has delivered prosperity for the state and connected elites, but at the cost of genuine broad-based capability development. The system’s reliance on foreign labor at both ends of the skill spectrum has created dependency rather than building domestic capacity commensurate with the country’s income level.

The Path Forward: Toward Authentic Development

Singapore stands at a crossroads. The administrative capacity, fiscal resources, and human talent exist to transition toward a more inclusive, sustainable model. This would require placing productivity and capability diffusion at the center of economic strategy, aligning immigration and industrial policy with these goals, sharing risk more fairly with households, and widening channels for citizen participation.

Such a transition would move Singapore from discretionary benevolence toward institutionalized confidence that rules are predictable and fair. It would sustain high income without leaning on ever-rising asset prices, grow wages at the base faster than essentials’ costs, and ease pressures that make everyday life feel precarious in one of the world’s richest cities.

Ultimately, a city-state’s greatest asset is the capability and confidence of its people. Building institutions that allow competition in markets and ideas—that trust and empower ordinary citizens rather than domestic and foreign elites—is the surest way to keep Singapore exceptional. Without this change, the headline numbers may stay impressive temporarily, but the trade-offs will sharpen, and the miracle will appear less as a model to emulate and more as a warning about development that prioritizes state power over human dignity.

The global South deserves development models that expand human capabilities and freedoms simultaneously—not systems that deliver macroeconomic success while constraining human potential. Singapore’s experience demonstrates both the possibilities and limitations of state-directed development, offering valuable lessons about what true prosperity requires beyond impressive economic statistics.